Raises a massive $220 million.

By The American Bazaar Staff

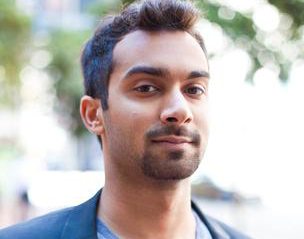

WASHINGTON, DC: Instacart, the San Francisco-based grocery delivery startup run by CEO Apoorva Mehta, has closed a $210 million investment, which skyrockets the company’s valuation to around $2 billion, making it the 15th biggest U.S. startup investments of the year.

A source told Re/code that the investment will increase to $220 million when all is said and done.

Just six months ago, Instacart was valued at about $400 million in a $44 million investment round led by venture capital firm Andreessen Horowitz. But the startup has grown rapidly this year — 2014 revenue will be north of $100 million, or 10 times more than it was in 2013, CEO Apoorva Mehta recently told The New York Times.

“We’re the retailer’s best friend,” he told The Times.

The Silicon Valley Business Journal reported that the company has now raised a total of about $275 million since it started in 2012 and its other investors include Sequoia Capital, Khosla Ventures, Canaan Partners, Y Combinator President Sam Altman and Box CEO Aaron Levie.

The company lets customers order groceries online from local stores such as Whole Foods and Costco and have them delivered on the same day. Instacart plans to expand into categories other than groceries in 2015, Mehta has said.

The massive investment comes as urban residents are showing a renewed interest in same-day delivery of groceries, more than a decade after delivery companies like Webvan and Kozmo burst onto the scene and then collapsed, reported Re/code. Instacart is also capitalizing on concerns among big grocery chains about Amazon expanding its grocery delivery business, and they are taking advantage of surging investor interest in the category.

The size of the raise signals that Instacart is intent on building a standalone business rather than selling to a big company such as Amazon or Google.

The Wall Street Journal reports that there have now been more than 40 startups that raised money worldwide at a valuation of $1 billion or more, double the number at the start of the year. Adjusted for inflation, there are now 70 of these so-called $1 billion unicorns, about twice as many as there were at the top of the tech bubble in 1999 and 2000.