“I believe the pharma company of the future isn’t going to be old-school,” says Ramaswamy.

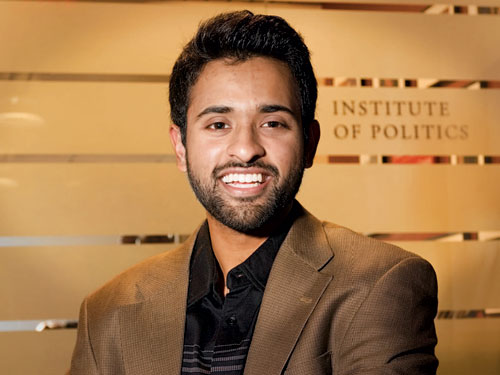

Indian American entrepreneur Vivek Ramaswamy, who is the founder of the biotech firm Roivant Sciences, has raised a whopping $1.1 billion from SoftBank Vision Fund and other investors.

Ramaswamy runs five subsidiary companies under Roivant Sciences that focus on five different diseases.

Axovant for neurology, Myovant for women’s health and endocrine diseases, Enzyvant for rare diseases, Dermavant for dermatology, and Urovant for urology.

Ramaswamy’s growth to success was the result of a win-win strategy that he adopted while acquiring other companies with great ideas that are unable to advance due to financial or strategic difficulties.

After the handover of the company, Roivant’s clinical development team initiate clinical and non-clinical studies and create a win-win proposition for the buyer and the seller.

ALSO READ: Vivek Ramaswamy, Apoorva Mehta make Forbes’ cut of richest entrepreneurs under 40 in the US

The Forbes magazine in 2016 had named Ramaswamy as the 24th richest American entrepreneur under 40 assessing his net worth at $600 million.

Ramaswami who has his roots in Kerala was born in Cincinnati, Ohio, after his parents migrated to the US. His father Vivek Ganapathy is an engineering graduate from the Regional Engineering College, Kerala, and his mother Geetha is a geriatric psychiatrist.

The deal closed by Roivant for $1.1 billion is the largest fundraising done by any other company in the life science sector. The highest amount raised till date is the $900 million by Grail, a cancer testing firm in March this year.

Talking to media Ramaswamy said the amount raised would be used to develop drugs that other companies have abandoned to produce due to various factors. He also shared his vision of building Roivant far from a stereotype pharmaceutical company.

ALSO READ: Axovant Sciences founded by Indian American Vivek Ramaswamy has biggest US biotech IPO

Interestingly, the announcement came just on the day he celebrated his 32nd birthday, on Wednesday.

Ramaswamy also added that the amount will be used for early research for the companies it will launch and on providing them with IT and other internal services. The Indian American on Wednesday announced a new subsidiary Datavant, a company that’ll be more tech-focused to speed up drug development.

“The ball’s in our court,” Ramaswamy said to Business Insider. “I believe the pharma company of the future isn’t going to be old-school.”

ALSO READ: 32 South Asian-origin leaders in Forbes’ list of 450 ’30 Under 30’ globally

Ramaswamy is also a former hedge fund manager who is behind Axovant Sciences’ staggering IPO. He previously worked as a partner at Dan Gold’s QVT and made the “Forbes 30 Under 30 in Finance” list in that capacity.

“We think we have a great drug candidate,” Ramaswamy told Forbes in 2015.