Offshore wealth of the United States has also increased inequality.

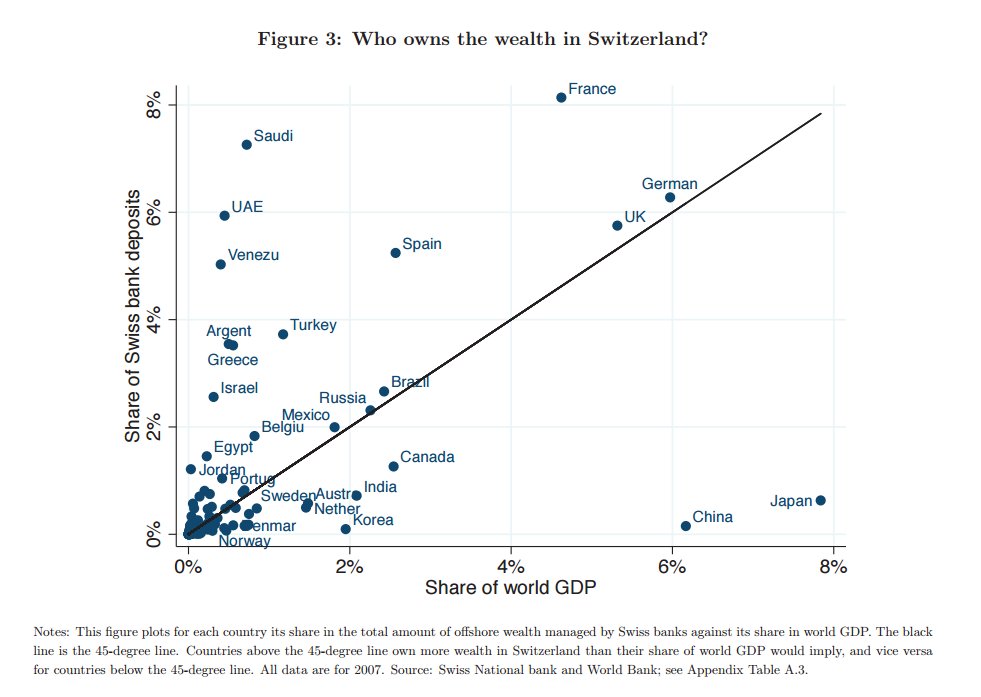

Contrary to public perception in India that wealthy Indians have stacked their money in Swiss banks, citizens of Indians are way behind when it comes to deposits in the European nation.

This was revealed in a paper circulated by the National Bureau of Economic Research (NBER).

The paper says that considering India’s share of the world GDP, Indians have very little money stacked in Swiss bank accounts.

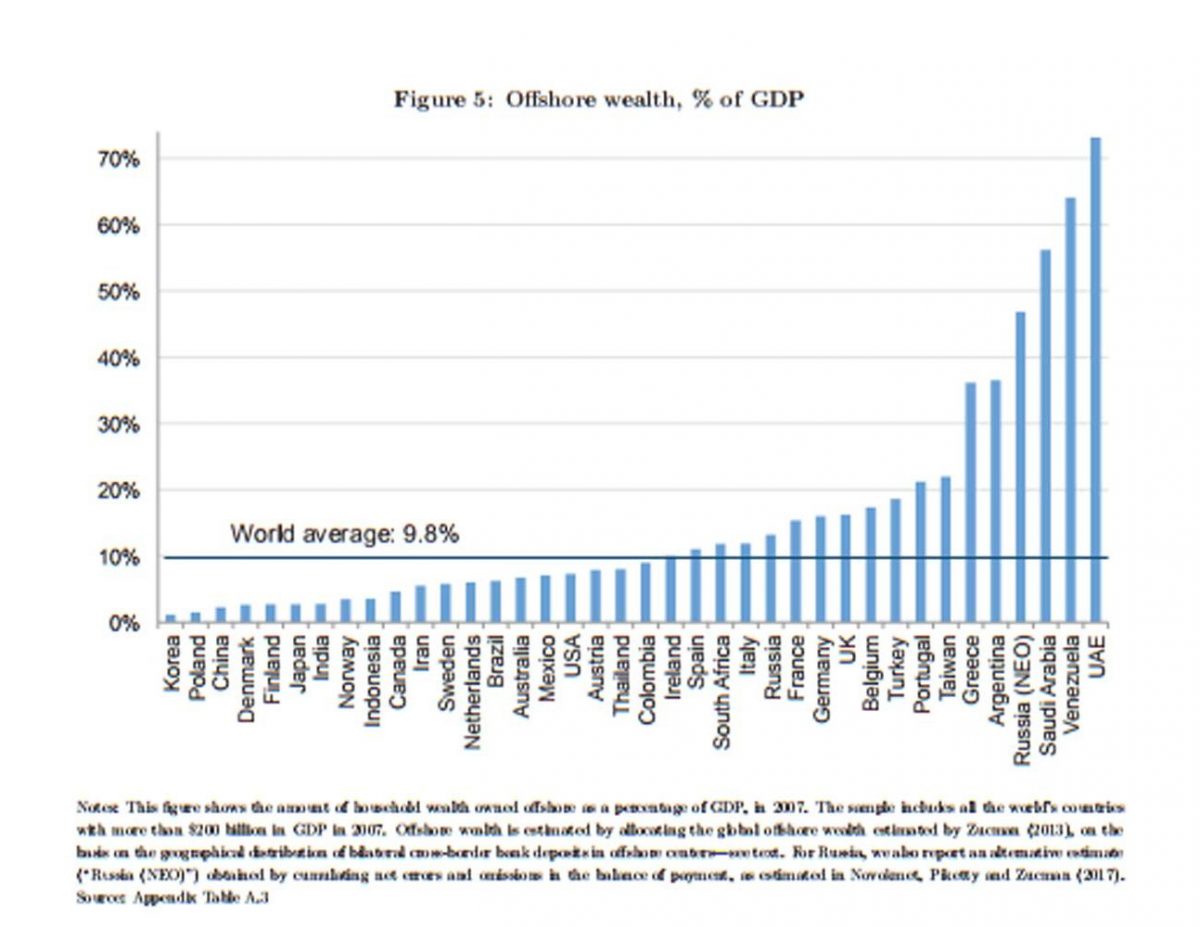

According to the paper, UAE stands on the top for stacking wealth in Swiss Banks followed by Venezuela, Saudi Arabia, Russia, Argentina, Greece, Taiwan, Portugal, Turkey, and then many Western European countries.

India is listed as the seventh country with least money amassed in tax havens, that too below the world average of 9.8 percent.

The research paper titled “Who Owns The Wealth In Tax Havens? Macro Evidence And Implications For Global Inequality” was co-authored by Annette Alstadsæter of Norwegian University of Life Sciences, Niels Johannesen of University of Copenhagen Department of Economics and CEBI, and Gabriel Zucman Department of Economics University of California, Berkeley.

The research paper estimated the amount of household wealth owned by each country in offshore tax havens.

The research was done on the basis of the data collected for several decades by the Bank for International Settlements (BIS), which was kept undisclosed until 2016. In 2016, most offshore centers authorized the BIS to disseminate bilateral data.

The authors said they have cross-checked their findings with the data leak from HSBC Switzerland and found surprisingly similar statistics on the distribution estimated for the entire Swiss banking industry.

The report said that the offshore wealth of the United States has also increased inequality, but the effect of it is not as staggering as in Europe because the US top wealth shares are already very high even disregarding tax havens.

The paper concludes that around 60 percent of the wealth of the richest households is held offshore.

The study said “offshore wealth is likely to have major implications for the concentration of wealth in many of the world’s developing countries, hence for the world distribution of income and wealth, which is the subject of growing interest.”

The paper concluded saying that no major financial center other than Switzerland publishes comprehensive statistics on the amount of foreign wealth managed by its banks, making it harder to measure the evolution of global wealth and its distribution. The researchers asked the policymakers to improve statistics on offshore wealth.

(This post has been updated.)